Revista Psicologia Organizações e Trabalho

ISSN 1984-6657

Prototypical dimensions of business opportunity in early stages of the entrepreneurial process1

As dimensões do protótipo de oportunidade de negócio nas fases iniciais do processo empreendedor

Sílvia Fernandes CostaI,2; Susana Correia SantosII; António CaetanoIII

IInstituto Universitário de Lisboa, ISCTE-IUL

IIInstituto Universitário de Lisboa, ISCTE-IUL

IIIInstituto Universitário de Lisboa, ISCTE-IUL

ABSTRACT

The purpose of this paper is to describe how individuals with no entrepreneurial experience use prototypical dimensions of business opportunities at the first two stages of the entrepreneurial process: recognition and decision to launch a venture. Previous studies have described the business opportunity prototype (Baron & Ensley, 2006); however, they do not describe how it is used and rely on retrospective data and entrepreneurs' prior experience. We intend to overcome these gaps by using two hypothetical scenarios and three conditions, creating a first entrepreneurial experience for individuals, having thus a 2 (scenario A and B) X 3 (condition: "Problem solving", "Cash flow", "Manageable risk") design plan with a total of six groups. Our results allow us to describe how individuals use the prototype in the first two stages of the entrepreneurial process. Specifically, we have a better understanding of the importance of risk, customers, and profit in both stages. Both in the recognition and the decision stages, risk is the most important factor, but profit and customers are considered differently in the two stages. In recognition, profit is more important than customers; however, in the decision stage, customers are a major concern for the participants. These results provide relevant information on the first entrepreneurial experience of individuals, which is crucial given the recognized need to promote entrepreneurial initiatives and behavior.

Keywords: Business Opportunities, Entrepreneurship, Prototypes.

RESUMO

O objectivo deste estudo é descrever a forma como indivíduos sem experiência empreendedora usam, pela primeira vez, o protótipo de oportunidade de negócio nas duas primeiras fases do processo empreendedor: reconhecimento e decisão para implementar a oportunidade de negócio. Estudos anteriores descrevem o protótipo de oportunidades de negócio; contudo, não descrevem a sua utilização e baseiam-se em dados retrospectivos e na experiência anterior de empreendedores. Neste estudo pretende-se cobrir estas falhas na literatura através de um plano experimental 2 (cenários A e B) ×3 (condições "resolve os problemas dos clientes", "gera lucro" e "risco gerível") com dois cenários hipotéticos e três condições, induzindo uma primeira experiência empreendedora aos participantes. Os resultados permitem descrever o uso do protótipo nas duas fases do processo empreendedor em análise. Especificamente, há um melhor entendimento de como o risco, clientes e lucro são importantes nas diferentes fases. Tanto na fase do reconhecimento como da decisão, o risco é o factor mais importante. Contudo, clientes e lucro são considerados de forma diferente nas duas fases: no reconhecimento o lucro é mais importante que os clientes, mas na fase de decisão os clientes são mais importantes. Estes resultados fornecem informação relevante sobre a primeira experiência empreendedora dos indivíduos, o que é crucial dada a importância reconhecida na literatura de se promoverem iniciativas e comportamentos empreendedores.

Palavras-chave: Oportunidade de Negócio, Empreendedorismo, Protótipos.

Entrepreneurship may be viewed as a process in which some individuals discover, evaluate, and exploit business opportunities (Shane & Venkataraman, 2000; Shane 2012). According to this definition, entrepreneurship research has been trying to know why, when, and how some people discover and make the most of business opportunities (Baum, Frese, Baron & Katz, 2007). To answer these questions, cognitive theory has been offering some insights on how individuals recognize business opportunities. Specifically, Baron and Ensley (2006) conducted a study to identify the prototypical features of the business opportunity prototype that entrepreneurs use to recognize business opportunities. The authors' work is very innovative. However, there are still some questions to be answered about the recognition process. Namely, it is important to know how individuals make use of the prototype at diffe-rent stages of the entrepreneurial process: could we assume that the same prototypical features perform the same role at the recognition and decision stages?

A second gap refers to the fact that the Baron and Ensley (2006) study relies on retrospective data, as the questions put to the entrepreneurs in their study referred to how they had recognized their business opportunity in the past. Recent studies (e.g., Grégoire, Barr & Shepherd, 2010) have been trying to use different methodologies to overcome this problem. However, they still rely on entrepreneurs' prior experience to draw their conclusions. These studies are important for describing entrepreneurial behaviour among entrepreneurs, but they are still based on their experience and on the way they perceive it, and do not provide relevant information regarding development and implementation strategies that may be used by potential entrepreneurs or would-be entrepreneurs, i.e., individuals with no experience. This is a crucial topic given the recognized need to promote entrepreneurial initiatives and behaviour.

Assuming that cognitive theory plays a fundamental role in explaining the process of opportunity recognition (Baron, 2004), this study aims to fill these gaps and explore the cognitive processes associated with recognizing entrepreneurial business opportunities. More specifically, (a) we intend to describe the use of the prototypical features of the business opportunity prototype in the first two stages of the entrepreneurial process, the so-called early stages of the process: recognition and hypothetical decision; and (b) we will describe the use of the prototype by individuals with no entrepreneurial experience.

THE ENTREPRENEURIAL PROCESS AND BUSINESS OPPORTUNITIES

There are several models describing the entrepreneurial process (e.g., Baron, 2007; Baron &Shane, 2008; Shane, 2003), and they all have some features in common: (a) they all consider that the process is organized in specific stages, (b) the models are based on an analysis of the same levels of variables: individual, group, and societal, and (c) the importance of these levels of variables may differ through the different stages.

Baron and Shane (2008) proposed an explanatory model for entrepreneurship. The authors considered that the process begins with the recognition of business opportunities. This recognition occurs when individuals identify a chance for creating something new through the observation of complex patterns of events in the environment. Grégoire, Barr and Shepherd (2010) have also stressed that within recognition of opportunities lies an evaluation of the opportunity for oneself. According to the authors, this part of the process has not been considered in most studies about opportunities recognition. In our opinion, an initial and very superficial assessment of the business implementation probability has to be made at this stage in order to proceed. Only with this evaluation is it possible for individuals, in the next stage, to decide to pursue the business idea. The analysis in the present study focuses on these first two stages of the entrepreneurial process: business opportunity recognition and decision to launch a venture. These two stages can be termed the early stages of entrepreneurial process.

Opportunities are situations under which new products, services, organizational methods, or materials are introduced in the market where their selling price is higher than their production costs (Casson, 2003). Entrepreneurial business opportunities imply some kind of novelty in the market. Baron (2006) considered that entrepreneurial business opportunities have three fundamental characteristics: potential economic value (capacity to make a profit), perceived desirability (acceptance from society and potential clients), and newness (inexistent product). Although the existence of opportunities is an objective phenomenon, recognizing and identifying them is subjective (Shane & Venkataraman, 2000; Shane, 2012). Baron (2006) stated that, frequently, opportunities existed before someone discovered them, which leads to a fundamental question: why is it that some individuals, but not others, can recognize business opportunities? Cognitive theory has contributed towards answering this question. Jackson and Dutton, (1987; 1988) have used cognitive theory to explain decision making in the evaluation of an event as being a threat or an opportunity, concluding that decision makers' cognitions often affected the processing of issues and actions in response to these events. Palich and Bagby (1995) proposed an explanation of entrepreneurial risk-taking based on cognitive theory, supporting that there were no differences in risk propensity between entrepreneurs and non-entrepreneurs, but that entrepreneurs categorized situations as having more strengths than non-entrepreneurs, and recognized more opportunities with more potential for gains than non-entrepreneurs. More recently, Baron (2004; 2006) has contributed in great extent to the explanation of entrepreneurial behaviour and opportunity recognition using cognitive theory.

EXPLAINING BUSINESS OPPORTUNITIES RECOGNITION ACCORDING TO COGNITIVE THEORY: "CONNECT THE DOTS" PERSPECTIVE

Baron (2006) considered that (1) opportunities arise from complex patterns of changing conditions - technological, economic, political, social, and demographic conditions that previously did not exist; (2) opportunity recognition is due to individual cognitive structures - mental constructions developed by individuals during life experiences. These structures organize information stored in memory making it useful at given times.

They also work as templates that allow individuals to interpret connexions between events that are, at first sight, unrelated. They provide cognitive basis to "connect the dots" between events in a changing pattern suggesting a business opportunity. In this sense, recognizing business opportunities is a repeated identification of patterns where individuals connect two or more events (dots) that may be related.

Prototypes are essential cognitive structures to this process. They mentally represent categories of objects and the common salient features that are often combined in an object.

Applying this model to business opportunity recognition is to say that individuals compare ideas of new products or services to their prototype of business opportunity, a mental structure that individuals have built up during their life experiences. If a match is possible, individuals will recognize and categorize it as a business opportunity (Baron, 2004).

Baron and Ensley (2006) conducted a study to describe the business opportunity prototype and identified five factors describing the business idea and five factors describing why entrepreneurs decided to exploit it. These ten dimensions constitute the entrepreneurs' prototype of a business idea. The first five describe the business idea itself: (1) solves customers' problems; (2) positive net cash flow; (3) manageable risk; (4) superior product; (5) changes industry. The other five refer to the feasibility of business development: (1) overall financial model; (2) advice from experts; (3) unique product; (4) big potential market; (5) intuition. Baron and Ensley's study is a contribution to the literature on entrepreneurship regarding business opportunities recognition explained by cognitive theory. However, their study relies on a retrospective, and therefore indirect, view of the recognition process by entrepreneurs, which has been noted in a study by Grégoire, Barr and Shepherd (2010). These authors also stated that prior knowledge and experience facilitates the process of business opportunities recognition, however this is never considered in the previous studies due to the retrospective view on the process. To account for this, Grégoire et al (2010) conducted a study with entrepreneurs using a think-aloud procedure with scenarios describing opportunities within the experience field of those entrepreneurs. The authors used their results to support the idea that the cognitive mechanism responsible for opportunities recognition is not a prototype, but structural alignment. Since both prototypes and structural alignment involve matching information with previous knowledge or experience, we do not think that these two perspectives are exclusive but interdependent. Moreover, classical theories on perception from Psychology (e.g., Gibson, 1966) supported, early on, the assumption that either basic categorization features or structural characteristics contribute to perception. However, both studies rely on the previous experience of their sample, which means that the conclusions might be due to entrepreneurs' prior experience and not to another cognitive mechanism, because the information they are receiving is not, in fact, completely new to them. Therefore, it is not possible to analyse how the cognitive structure is developed and used. In this study we intend then to present new information to individuals with no entrepreneurial experience. We will lead them into a first entrepreneurial episode with the potential for developing the prototype and recognizing a business opportunity.

We will consider the prototype perspective and its description suggested by Baron and Ensley (2006).Using this theory we hope to clarify the use of this mental structure on opportunities recognition. Consequently, this study aims to verify if some dimensions of the prototype are identified by individuals with no entrepreneurial experience. In addition to that, we will also analyse how the dimensions of the prototype are used in the recognition stage and how important they are when deciding to launch a venture. These goals are set at two different levels: (1) recognizing business opportunity, which comprises opportunity identification and a first assessment of implementation probability according to business characteristics; and (2) deciding to launch the business. We do not intend, therefore, to evaluate the complete entrepreneurial process but only the beginning of it, its two first stages, the so-called early entrepreneurship stages. It is expected, therefore, that prototypical dimensions are used differently in each stage. While in the first stage (recognition) individuals have to recognize business opportunity and evaluate the probability of its implementation, in the second stage (primary decision) individuals face tangible actions and engage in a decision-making process to launch the business venture. As Baron and Shane (2008) claimed, one exits the realm of "idea" and gets ready for action. For this reason, business opportunity characteristics also assume different levels of importance at different stages. According to Alsete (2008), desire to make a profit was an important motivation in recognizing an entrepreneurial business opportunity. This may also lead entrepreneurs to evaluate risk differently from non-entrepreneurial individuals, though that does not mean they are more willing to take risks (Baron, 2004). Gray and Eylon (2002) considered that clients and their satisfaction are important factors in evaluating the effectiveness of business opportunities. Since these business characteristics are fundamental to analysing opportunities, it is relevant to verify how individuals with no experience do so using the prototype at different stages of the entrepreneurial process.

METHOD

Study Design

We designed a 2×3 experimental plan, using two hypothetical scenarios and three conditions. As in other research fields, a number of studies on entrepreneurship have used scenarios to evaluate the individual decision-making process and risk perception, among other topics (Jackson & Dutton, 1988; Burmeister & Schade, 2007; Doff, 2008; Wasieleski & Webber 2008; Doyle, Hughes & Summers, 2009; Ng, White, Lee & Moneta, 2009; Costa & Caetano, 2013). More recently, Grégoire, Barr and Shepherd (2010) have also used scenarios to assess the cognitive mechanism of opportunities recognition by entrepreneurs. We developed scenarios specifically for this study. Each one described a business opportunity based on authentic events.

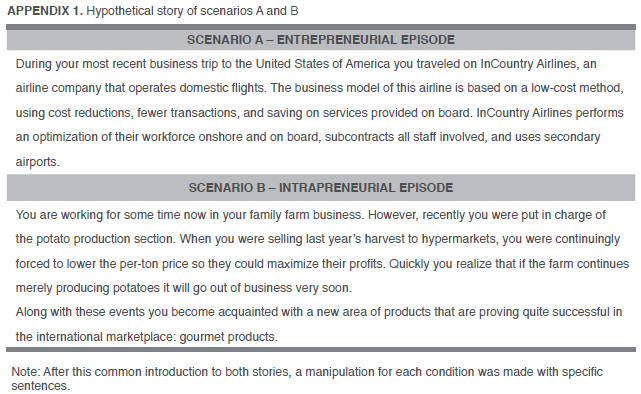

Scenario A described a business opportunity suggesting the creation of a low-cost airline, based on the true story of a low-cost airline (Rae, 2007). Scenario B described a business opportunity favourable to producing gourmet products, specifically potato chip snacks. This story was based on the actual development of a potato chip company (Rae, 2007).

To examine how individuals use the business opportunity prototype when evaluating implementation probability, each scenario manipulated different information based on the dimensions of the prototype of business opportunity as defined by Baron and Ensley (2006). Therefore, each scenario (A and B) had three conditions according to three different business characteristics: (1) solves customer problems, (2) positive net cash flow, and (3) manageable risk (conditions "Problem solving", "Cash flow", "Manageable risk"). These characteristics matched three dimensions of the business opportunity prototype proposed by Baron and Ensley (2006). In this study, we used only these three dimensions because they were the ones most relevant to explaining the business opportunity prototype in the authors' model. Another reason for choosing these three dimensions had to do with the fact that these were the only ones, from a total five, that did not require comparison with other products (as is the case with "superior product" dimension) nor the knowledge of a complete market/industry (as is the case with "change industry" dimension) and could be fully understood from the information on the presented scenarios. In Appendix 1 we present the description of the common part for both scenarios.

According to Baron and Ensley (2006), each of these dimensions (i.e., (1) solves customer problems, (2) positive net cash flow, and (3) manageable risk) is made up of several items. So, in order to manipulate them, we operationalized each item in a sentence. For example, scenario A described a situation favourable to the creation of a low-cost airline company and it had three conditions ("Problem solving", "Cash flow", "Manageable risk"). Each condition had the same introduction but then different information was presented according to the manipulated dimension. Before conducting the analysis, the scenarios were pre-tested. Those results, however, are not presented here for reasons of parsimony, although information on manipulation effectiveness of scenarios is given in the results section.

The present study is a 2 (scenario A and B) X 3 (condition: "Problem solving", "Cash flow", "Manageable risk") design plan with a total of six groups. Since each scenario had three conditions, results concerning scenario A and B will be analysed separately by condition.

Participants

Ninety Portuguese students from a public university participated in this study (15 per condition); 34% were male and 66% female. Individuals were randomly allocated to conditions. The participants' ages ranged between 18 and 28, their average age being 20 years old. The students belonged to different study fields (none of them related directly to entrepreneurship) and the majority (74%) were undergraduates while the remaining 26% were enrolled in graduate programs.

In order to control participants' entrepreneurial experience we asked them if they had ever been engaged in an entrepreneurial episode. Each individual participating in the study had already thought up, on average, 4 business ideas (M = 3.9); none of them had ever launched a business venture.

Procedure

Data collection was conducted using a questionnaire and lasted about 15 minutes. Participants were recruited on the university campus and were asked to complete the questionnaire uninterruptedly and individually. They were told that their participation was voluntary and their data confidential.

Before presenting the scenario, some instructions were given to participants: they were told to carefully read the story imagining themselves as the subject. After reading the scenario, they were asked to describe the business opportunity according to a scale, presented ahead, concerning business opportunity characteristics. Following this task, participants were asked about the probability of implementing that business opportunity venture. Finally, participants were asked to classify the factors that were important in deciding to launch the venture.

Instruments and Measures

To assess business characteristics, we asked participants to complete a scale of 14 items describing the three dimensions of the recognition stage of the business opportunity prototype. These items were based on the original work of Baron and Ensley (2006). All the items were developed under a process of translation and back translation to ensure that the meaning was kept. Originally, the items that constitute the dimensions of the business opportunity prototype were written in English. We then used these items to make sentences that could be rated on a scale, which we did in English. Afterwards, these items were translated to Portuguese and back to English. Participants were to answer the question "In your opinion, are the following items a characteristic of the business idea presented before?" on a scale ranging from 1 ("not at all") to 5 ("very much so"). The aim of these 14 items was to assure manipulation effectiveness and to check whether participants considered that the business opportunities would actually solve customers' problems, generate cash flow, and have a manageable risk.

The prototypical dimension "solves customers' problems" was measured by 5 items ("Meets customers' needs"; "Is demanded by customers for a long-time"; "Relieves customers' pain/problems"; "Is life-improving"; "Is wanted by customers"). The "positive net cash flow" dimension was also measured by 5 items ("Is profitable"; "Generates lots of cash"; "Can make lots of money"; "Makes a quick profit"; "Represents a short cash burn"). Finally, the "manageable risk" dimension was measured by 4 items ("Customers accept it"; "Requires few technological changes"; "Has few liabilities"; "Has risks in production"). Then, to assess the probability of business implementation, we asked participants: "If guaranties were given to you to launch the business opportunity described earlier, what would be the probability of your doing it?". Answers were given on a scale ranging from 0% to 100%.

Finally, to assess the importance of factors related to deciding to launch a venture, we used a total of 24 items, also based on the five dimensions of the business prototype regarding the feasibility of business development. "Unique product" was measured by 5 items ("It is unique"; "There is nothing like it"; "It is different from others"; "It has new technology"; "It has a different application"); "overall financial model" was measured by 5 items ("It has a favourable financial model"; "It has high margins of profit"; "It allows a quick cash-flow"; "It has a short sales cycle"; "It involves a low investment and high return"); "advice from experts" was measured by 4 items ("My friends told me"; "A financial advisor told me"; "A consultant told me"; "A legal counsel advised me"); "big potential market" was measured by 5 items ("It has a large market"; "It satisfies unmet needs"; "It is easy to enter the market"; "It has few competitors"; "It is mass-market oriented"); and "intuition" was measured by 5 items ("It is very logical"; "It will work"; "It is a good deal"; "It is not doubtful"; "I have a gut feeling about it").

Participants indicated, on a scale of importance ranging from 1 (it is not important) to 5 (it is very important), what degree of importance some factors would have with regard to deciding to launch the business opportunity described earlier. Once again, these items are based on the Baron and Ensley (2006) study.

RESULTS

Business Characteristics and Scenarios Manipulation

We performed an exploratory factor analysis to identify the prototype dimensions concerning business opportunity characterization, similar to what Baron and Ensley (2006) had done in their study. We extracted three factors that are analogous to the manipulated prototypical dimensions: satisfies customers' needs (α = 0.78), profitable (α = 0.91), and controllable risk (α = 0.67). Table 1 describes the factor analysis data.

Table 2 provides information on participants' business opportunity characterization by scenario and condition. We can observe that in scenario A, for condition "Problem solving", participants consider that the business opportunity is best characterized by satisfying customers' needs (M = 3.41); for condition "Cash flow", participants consider that the business opportunity is best characterized by its capability of being profitable (M = 4.02); and for condition "Manageable risk", participants characterize it as being more able to satisfy customers' needs (M = 4.27).

For scenario B, in the conditions "Cash flow" and "Manageable risk", participants consider that the business opportunity is best characterized by being profitable (M =3.71 and 3.78, correspondingly). In the condition "Problem solving", participants consider that it is best described by its ability to satisfy customers' needs (M = 3.53).

To verify whether manipulation has a significant effect on characterizing business opportunity, a multivariate analysis was performed. The answers for each of the characterization variables should be higher in the manipulated condition that is associated with it (e.g., solves customers' problems should have higher values in condition "Problem solving"). In scenario A, there is a significant effect of condition ("Problem solving", "Cash flow", "Manageable risk") on business opportunity characterization by participants (F(6,58)=4.79;p<0.05) and it explains 33.1% (Partial Eta2=0.331) of variance in the answers. In scenario B multivariate tests show that manipulation explains 11.9% (Partial Eta2=0.119) of the business opportunity characterization by participants. However, this effect is not significant (F(6,56)=1.26; p>0.05), which reveals that scenario B may have some manipulation limitations.

BUSINESS CHARACTERISTICS, ASSESSMENT OF BUSINESS IMPLEMENTATION PROBABILITY AND DECISION TO LAUNCH THE VENTURE

For both scenarios A and B it is in condition "Manageable risk" that percentage values are higher (MA=62.87%, MB=67.86%, in that order), followed, in both cases, by the condition "Cash flow" (MA=56.13%, MB=62.86%) and, in third place, by the condition " Problem solving" (MA=55.33%, MB=60.77%). This answer was given on a 0% to 100% probability of implementation scale.

Concerning the decision to launch a venture (the second stage under analysis), we performed an exploratory factor analysis to identify the prototype dimensions associated with the decision to launch the business venture. Extracted factors are similar to those in the Baron and Ensley (2006) study, which explain the decision to launch a venture. Table 3 shows the factors: it's unique (α =0.89), intuition (α = 0.85), favourable financial model (α =0.75), and advice (α =0.93).

Table 4 provides information on participants' perceived importance of these factors by scenario and condition. In scenario A, condition "Problem solving", the advice factor is what best justifies the decision to launch the venture (M = 3.36). In condition "Cash flow" it is the favourable financial model that most contributes to the decision (M= 3.63). Finally, in condition "Manageable risk", it is the advice factor that best supports the decision (M=4.08).

In scenario B, the favourable financial model shows higher average answers than the other factors in all conditions.

We performed a univariate analysis to verify the effect of business opportunity characteristics on the perceived importance of decision factors (compute decision factors =(intuition,favourable financial model, it's unique, and advice)/4). For scenario A, the business opportunities characteristics (conditions "Problem solving", "Cash flow", "Manageable risk") have a significant effect on participants' answers (F(2,34)=3.86; p<0.05). Results show that it is in condition "Manageable risk" that answers are higher (M = 3.86). However, in contrast to what happened in the implementation probability assessment stage, what best explains the decision to launch the business venture, after risk, is the capability of the business opportunity to satisfy customers' needs (M= 3.24) and not its ability to generate cash flow (M=3.11). In scenario B this model is not significant, which means that business characteristics do not significantly affect differences in the answers.

DISCUSSION

The present study aimed to understand how individuals with no entrepreneurial experience use the business opportunity prototype in two different stages of the entrepreneurial process: initial assessment of implementation probability (when recognizing the opportunity) and deciding to launch the business venture. In order to accomplish this purpose, we used an experimental study with a 2×3 design. Using a scenario approach, the results allowed us to identify and replicate some prototypical dimensions of business opportunities, in accordance with the Baron and Ensley (2006) model. Moreover, it allowed us to understand how participants used them at different stages of the entrepreneurial process. In business opportunity recognition, business risk is the individuals' primary concern. The second most important dimension is its capability of generating a profit, and lastly its capacity to satisfy customers' needs. When they analyse the business opportunity from a decision-making point of view (second stage of the process), individuals also begin by examining the risk involved, but then their attention focuses on the business opportunity's capacity to satisfy customers' needs, and the profit issue comes in third place.

As Baron and Shane (2008) stated, different stages of the process correspond to different activities. The results in the present study also supported that idea, because individuals showed different reasoning methods through the different perceived stages of the process, even in their first entrepreneurial experience. Baron and Shane (2008) claimed that in the first stage, individuals evaluate the business opportunity based on a simple "idea", something intangible. As we verified, at this stage although attention is given to risk, it comes immediately followed by the analysis of possible profit. Moving to the next stage requires individuals to engage in "real" actions and to decide to actually launch the business venture, which leads individuals to analyse the business opportunity more realistically. Risk again was first among the features analysed, but at this stage it is concern for customers that follows, instead of profit. This analysis is, in fact, more realistic because no business can survive without acceptance or desirability from potential clients (Baron, 2004). Moreover, literature also points out that the financial rewards of entrepreneurship can have different levels of importance during the business life cycle (Carter, 2011), and our results seem to corroborate this evidence. Despite the fact that we were using potential scenarios, the participants gave different importance to the risk dimensions at the two stages of the entrepreneurship process, suggesting that also in the intentions domain, risk can have a different role. These conclusions are congruent with the importance of risk, clients, and profit referenced in the literature, supporting what was expected: their importance can vary according to the stage of the entrepreneurial process.

Although manipulation was similar in both scenarios, significant differences were found in the way participants considered them capable of satisfying customers' needs. However, looking back at the story content, it is possible to understand these differences. Scenario A related to a story favourable to creating a low-cost airline company, whereas scenario B related to a story favourable to producing gourmet-potato chips. It is possible that participants considered that a low-cost airline was more desirable than a gourmet potato chip snack. Considering that one fundamental characteristic of entrepreneurial business opportunities is the fact that they should be perceived as desired (Baron, 2006), it is understandable that differences were found. With regard to manipulation, the condition "Manageable risk" does not show higher responses for the business characteristic controllable risk, as was expected. To explain this, it is important to recall what the literature indicates about risk: people acting in entrepreneurial scenarios are not more willing to take risks, but they do analyse them differently (Baron, 2004).

Limitations and Contributions

Some limitations of the present study should be pointed out. Scenario B showed some manipulation limitations. However, that setback was taken into account in the statistical analysis.

Another limitation of our study has to do with the fact that although efforts were put forth to construct entrepreneurial scenarios that participants would analyse, this does not constitute an actual entrepreneurial experience. The students have not effectively launched a business. However, given that university students have attitudes towards entrepreneurship (e.g., Athayde, 2009) and have an entrepreneurial potential (e.g., Santos, Caetano & Curral, 2010), we believe that this may constitute a reliable way of collecting their impressions and attitudes towards entrepreneurship.

Regarding the factor analysis performed in this study, some items did not load clearly on only one factor. When in doubt we chose the one corresponding to Baron and Ensley's original model. Moreover, it is understandable that not all items load exactly and clearly on the same factors from the author's original paper, because, according to them, more-experienced entrepreneurs tend to have richer and better defined prototypes than non-experienced ones. Since our sample consists of students having their first entrepreneurial experience, it is understandable that this might happen with some items.

Finally, concerning the tests performed for comparison of means, each group in the analysis registered 15 observations, and this can be considered a limitation according to Hair et al (2009), who suggest that observations must be more than twenty. Nevertheless, there are other authors who highlight that sample size can be less than 20 if there is homogeneity of variance across groups (e.g., Keppel & Mickens, 2004). Levene's test of equality of variance in all the variables and across groups showed that there is homogeneity of variance. Moreover, Field (2009) also suggested that if the sample sizes are equal in all the groups, the power and reliability of the test is assured.

Despite previous limitations, the present study brings some important theoretical contributions. Specifically, our results affirm that cognitive theory and "connect the dots" perspective are fundamental to understanding the entrepreneurial process, specifically business opportunities recognition. More broadly, our findings also contribute to a crucial topic within entrepreneurship research: the individual-opportunity nexus presented by Venkataraman (1997). The author has stated that the general framework of entrepreneurship includes the examination of entrepreneurial opportunities, the individuals who discover and exploit them, the role of the processes of resources acquisition and organization, as well as the strategies that allow the exploitation and protection of profits. The individual-opportunity nexus is consistent with the entrepreneurial process perspective we take in this paper. In fact, the first element of the entrepreneurial process is recognizing business opportunities (Baron & Shane, 2008), and the nexus perspective also posits that the first element of the entrepreneurial process is the perception of the existence of a business opportunity (Shane, 2003; Caetano, Santos & Costa, 2012). Thus, the individual discovers them. This is the core of the individual-opportunity nexus in entrepreneurship. Therefore, there is no entrepreneurship without opportunities and individuals, or groups of individuals, who discover, exploit, and execute them (Shane, 2003). The individual-opportunity nexus is the building block to understanding entrepreneurship (Shane, 2012). Entrepreneurship requires objective entrepreneurial opportunities, and individuals who are enterprising (Shane, 2012). By focusing on how individuals with no entrepreneurial experience use prototypical dimensions of business opportunities at the first two stages of the entrepreneurial process, this paper and its findings stress again the importance of the existence of an opportunity and of individuals who recognize this. It also shows that in different stages of the process this relationship between individuals and opportunities changes and evolves, but it is always crucial to the process and it can be explained by cognitive theory.

Methodologically, this study is also relevant because it uses scenarios to present an actual entrepreneurial situation to individuals, which has been supported by some authors (e.g., Davidsson, 2004). Previous studies have used retrospective data from entrepreneurs (e.g., Baron and Ensley, 2006) or used experiments in very specific areas of knowledge (e.g., Gregóire et al, 2010). Finally, it is important to stress that we do not intend to explain the behaviour of entrepreneurs, but rather that of individuals with no entrepreneurial experience who faced their first episode in this study.

Practical Implications and Future Directions

As to practical implications, this study provides important input on how individuals recognize business opportunities in a first entrepreneurial experience, which can be important in designing entrepreneurship learning programs and in helping individuals successfully evaluate business opportunities. For instance, Pittaway, Missing, Hudson and Maragh (2009) point to the importance of active learning in entrepreneurship training programmes in order to enhance management development of entrepreneurial businesses. It is also important to consider these conclusions on how individuals actively recognize business opportunities in a first entrepreneurial episode in these programmes. There is also currently another important topic established in entrepreneurship literature: the need to create and stimulate entrepreneurship at universities. This is a crucial topic in entrepreneurship literature nowadays: how can we promote entrepreneurial initiatives and entrepreneurial behaviour? Some authors (e.g., Heinonen, 2007; Colombo, Mustar & Wright, 2010; Wright, Piva, Mosey & Lockett, 2009) stress the importance of the university and the role of the university student in this task. In this sense this study is also relevant as it explains how university students may consider the early stages of entrepreneurial activity.

Future research should revalidate the models and measures presented in this study with samples of entrepreneurs and would-be entrepreneurs. The addition of other measures, such as personal characteristics and competencies, (Mithcelmore & Rowley, 2010) would also be relevant. Also, gender comparison on the use of the prototype would be relevant given the importance that this stream of research has at present. Other studies have been stressing the importance of entrepreneurial teams (e.g., Chen, 2007) and it would be important to understand how business opportunities recognition occurs also within a team. Therefore, some measures not only considering business opportunity recognition but its antecedents, such as networking strategies and creativity, might also be considered.

REFERENCES

Alsete, J. W. (2008). Aspects of entrepreneurial success. Journal of Small Business and Enterprise Development, 15,584-594. [ Links ]

Athayde, R. (2009). Measuring enterprise potential in young people. Entrepreneurship Theory and Practice, March (44),481-501. [ Links ]

Baron, R. & Shane, S. (2008). Entrepreneurship - A process perspective (2º Edition). Canada: Thomson. [ Links ]

Baron, R. (2004). The cognitive perspective: a valuable tool for answering entrepreneurship's basic ''why'' questions. Journal of Business Venturing, 19,221-239. [ Links ]

Baron, R. (2006). Opportunity recognition as pattern recognition: How entrepreneurs "connect the dots" to identify new business opportunities. Academy of Management Perspectives, February, 104-119. [ Links ]

Baron, R. (2007). Entrepreneurship: A process perspective. In J. Baum, M. Frese, & R. Baron (Eds.). Psychology Entrepreneurship (pp. 19-39). Mahwah, New Jersey: Lawrence Erlbaum Associates, Publishers. [ Links ]

Baron, R., & Ensley, M. (2006). Opportunity recognition as the detection meaningful patterns: Evidence from comparisons of novice and experienced entrepreneurs. Management Science, 52,1331-1344. [ Links ]

Baum, J., Frese, M., Baron, R., & Katz, J. (2007). Entrepreneurship as an area of psychology study: An introduction. In J. Baum, M. Frese, & R. Baron (Eds.), Psychology Entrepreneurship (pp. 1-18). Mahwah, New Jersey: Lawrence Erlbaum Associates, Publishers. [ Links ]

Burmeister, K. & Schade, C. (2007). Are entrepreneurs' decisions more biased? An experimental investigation of the susceptibility to status quo bias. Journal of Business Venturing, 22,340-362. [ Links ]

Caetano, A., Correia Santos, S., & Costa, S. F. (2012). Psicologia do Empreendedorismo: Processos, Oportunidades e Competências. Lisbon: Mundos Sociais. [ Links ]

Carter, S. (2011). The rewards of entrepreneurship: Exploring the incomes, wealth, and economic well-being of entrepreneurial households. Entrepreneurship Theory and Practice, January, 39-55. [ Links ]

Casson, M. (2003). The Entrepreneur: An economic theory (2nd edition).Cheltenham: Edward Elgar Publishing Limited. [ Links ]

Chen, M.H. (2007). Entrepreneurial leadership and new ventures: Creativity in entrepreneurial teams. Entrepreneurial Leadership and New Ventures, 16,239-249. [ Links ]

Colombo, M., Mustar, P., & Wright, M. (2010). Dynamics of science-based entrepreneurship. Journal of Technology Transfer, 35,1-15. [ Links ]

Costa, S. F., & Caetano A. (2013). Entrepreneurship and intrapreneurship in academic contexts: How students recognize business opportunities. In T. Baaken, A. Meerman, M. Neuvonen-Rauhala, T. Lähdeniemi, T. Ahonen, & T. Kliewe (eds.), Entrepreneurial Universities Conference Proceedings (pp. 33-40). Münster: Münster University of Applied Sciences. [ Links ]

Davidsson, P. (2004). Researching entrepreneurship. New York: Springer. [ Links ]

Doff, R. (2008). Defining and measuring business risk in an economic-capital framework. The Journal of Risk Finance, 9,317-333. [ Links ]

Doyle, E., Hughes, J. & Summers, B. (2009). Research methods in taxation ethics: Developing the Defining Issues Test (DIT) for a Tax-Specific Scenario. Journal of Business Ethics, 88,35-52. [ Links ]

Field, A. P. (2009). Discovering statistics using SPSS: And sex and drugs and rock 'n' roll (third edition). London: Sage publications. [ Links ]

Gibson, J. J. (1966). The senses considered as perceptual systems. Boston: Houghton Mifflin Company. [ Links ]

Gray, S., & Eylon, D. (2002). Clients' perceptions of the effectiveness of small business development centers. Journal of Business and Entrepreneurship, 14,57-68. [ Links ]

Grégoire, D. A., Barr, P. S., & Shepherd, D. A. (2010). Cognitive processes of opportunity recognition. Organization Science, 21,413-431. [ Links ]

Hair, J.F., Black, W.C., Babin, B.J., Anderson, R.E., & Tatham, R.L. (2009). Multivariate data analysis (7th edition). Upper Saddle River, NJ: Pearson Education. [ Links ]

Heinonen, J. (2007). An entrepreneurial-directed approach to teaching corporate entrepreneurship at university level. Education and Training, 49,310-324. [ Links ]

Jackson, S. & Dutton, J. (1988). Discerning Threats and Opportunities. Administrative Science Quarterly, 33,370-387. [ Links ]

Jackson, S., & Dutton, J. (1987). Categorizing strategic issues: Links to organizational action. Academy of Management, 12,76-90. [ Links ]

Keppel, G., & Mickens, T. D. (2004). Design and analysis: A researcher's handbook (4th Edition). Berkley, CA: Pearson Higher Ed USA. [ Links ]

Mithcelmore, S., & Rowley, J. (2010). Entrepreneurial competencies: A literature review and development agenda. International Journal of Entrepreneurial Behaviour and Research, 16,92-111. [ Links ]

Ng, J., White, G., Lee, A., & Moneta, A. (2009). Design and validation of a novel new instrument for measuring the effect of moral intensity on accountants - Propensity to manage earnings. Journal of Business Ethics, 84,367-387. [ Links ]

Palich, L. & Bagby, D. (1995). Using cognitive theory to explain entrepreneurial risk-taking: Challenging conventional wisdom. Journal of Business Venturing, 10,425-438. [ Links ]

Pittaway, L., Missing, C., Hudson, N., & Maragh, D. (2009). Entrepreneurial learning through action: A case study of the Six-Squared program. Action Learning: Research and Practice, 6,265-288. [ Links ]

Rae, D. (2007). Entrepreneurship from opportunity to action. London: Palgrave. [ Links ]

Santos, S. C., Caetano, A., & Curral, L. (2010). Atitude dos estudantes universitários face ao empreendedorismo: Como identificar o potencial empreendedor? Revista Portuguesa e Brasileira da Gestão, 9(4),2-14. [ Links ]

Shane, S. & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. Academy of Management Review, 25,217-226. [ Links ]

Shane, S. (2003). A general theory of entrepreneurship: The individual-opportunity nexus approach to entrepreneurship. Alderchot, UK: Edward Elgar. [ Links ]

Shane, S. (2012). Reflections of the 2012 AMR decade award: Delivering on the promise of entrepreneurship as a field of research. Academy of Management Review, 37(1),10-20. [ Links ]

Venkataraman, S. (1997). The distinctive domain of entrepreneurship research: An editor's perspective. In J. Katz, & R. Brockhaus (eds.), Advances in Entrepreneurship, Firm Emergence, and Growth,(pp.119-138), Greenwich, CT: JAI Press. [ Links ]

Wasieleski, D. & Weber, J. (2008). Does job Function influence ethical reasoning? An adapted Wason task application. Journal of Business Ethics, 85,187-199. [ Links ]

Wright, M., Piva, E., Mosey, S., & Lockett, A. (2009). Academic entrepreneurship and business schools. Journal of Technology Transfer, 34,560-587. [ Links ]

Recebido em: 31.05.2012

Aprovado em: 02.10.2013

1 This work was supported by the Foundation for Science and Technology, Portugal [PhD Grant number SFRH/BD/76079/2011] and [PEst-OE/EGE/UI0315/2011].

2 Endereço para correspondência: Sílvia Fernandes Costa, BRU - Business Research Unit, Instituto Universitário de Lisboa (ISCTE-IUL), Av. Das Forças Armadas, Edífico ISCTE, Room 2W8, 1649-026 Lisboa, Portugal. E-mail: silvia_fernandes_costa@iscte.pt